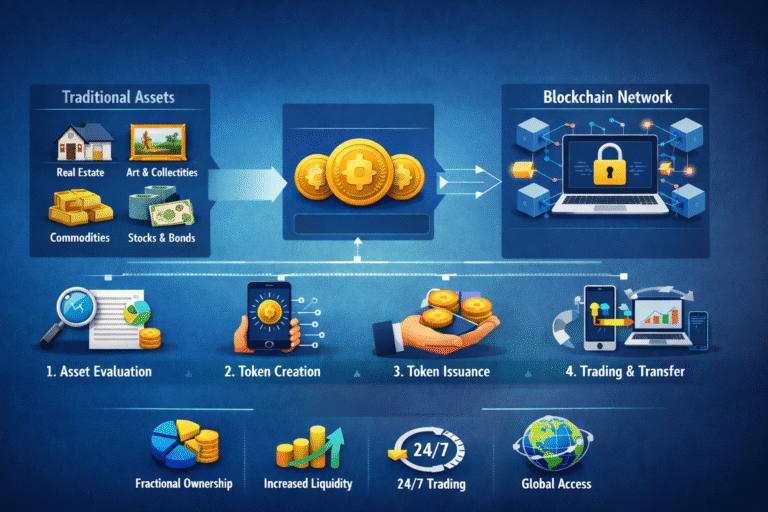

Asset tokenization on blockchain turns real-world assets into secure digital tokens, enabling faster transactions, and global access.

Asset tokenization is revolutionizing finance by turning real-world assets into secure, tradable digital tokens. These tokens provide for faster transactions, lower costs and instant global access for investors. Blockchain makes ownership transparent and tamper-proof while fractionalization makes high-value assets accessible to everybody.

Blockchain Tokenization Explained Simply

Tokenization in blockchain is the process of converting sensitive asset into secure digital asset called token. First, original data remains safe while tokens help to safely execute daily operations. Moreover, blockchain tokens pass value and information only efficiently. These programmable units enhance liquidity, transactions speed up and transparency is enhanced. Therefore, tokenization is a boon to finance, data security and wider digital ecosystems in the world today and globally.

Digital Ownership on Distributed Ledgers

Digital ownership on distributed ledgers means that control shifts from access based licenses to verifiable asset based digital ownership models. Moreover, assets get tokenized in the form of digital tokens that are secured on the decentralized blockchain ledgers.

Once consensus is made and validated, the records cannot be changed and collaborate ownership permanent. Additionally, smart contracts automate transfers, eliminate intermediaries, increase transparency, improve security, and increase access throughout modern financial markets.

Why Tokens Cannot Be Duplicated or Altered

Tokens are difficult to duplicate/substitute since systems have control over making them unique, encryption, and a set of stringent rules to maintain data integrity. For example, Bitcoin has more than 1,000,000 nodes that are secured by hash-linked blocks. Similarly, Ethereum has a huge number of smart contracts processed more than 1,000,000 per day and executing theology of unwavering ownership.

In Cybersecurity, JWT token uses 256-bit cryptographic signatures with strict expiry timestamp. Therefore, copied visuals can never copy authority, value or control across blockchain, security or gaming systems.

Types of Blockchain-Based Tokens

Blockchain-based tokens are of two types – fungible and non-fungible – which fulfil different economic and technical purposes. Fungible tokens are still open to interchanging, like in fiat currencies, to enable payment, governance, stability & platform utility. In 2024, stablecoins such as USDT and USDC measured upward of $10T in transactions on the world’s blockchain.

Fungible types include utility tokens such as BAT, governance tokens such as UNI and payment tokens such as BTC. Meanwhile, NFTs are unique and irreplaceable that helps in powering the digital art, gaming assets and also tokenize real-world items. NFT Markets Trading volumes across this period (2023 in general) this segment of the market recorded $24B+, highlighting the overall adoption from different sectors.

Digital Instruments Back by the Valuable

Value-backed digital instruments are blockchain tokens that are linked to assets such as USDT, USDC, gold, tokenized bonds, and CBDC. In 2025, There were more than $10 trillion processed by stablecoins that reflect their safer alternatives to volatile cryptocurrencies and bridge traditional finance and DeFi.

These instruments provide for stability, efficiency, and transparency. Fractional real estate or art ownership increases accessibility and tools such as Cryptio for the verification of reserves. Some of the risks are the reliability of reserves, counterparty dependency, and lack of clarity of regulations under EU MiCA. Global adoption is expected to reach over $350 billion in 2026.

Access-Oriented Network Units

Access-oriented network units use blockchain tokens to control user access to networks, services and dApps. Utility tokens such as Filecoin (FIL) and Basic Attention Token (BAT) for enabling access and ecosystem functioning.

In 2025, Filecoin handled more than $1.2 billion in storage transactions, indicating increased adoption. Through these tokens, decentralized participation, automated access by smart contracts and secure energy trading are possible.

Native Blockchain Exchange Assets

Native blockchain exchange assets are cryptocurrencies issued by exchanges to be used to propel their respective ecosystems, liquidity as well as user incentives. Currently, leading assets such as BNB, Cronos (CRO), and Uniswap (UNI) are dominating their platforms in terms of high market caps, high trading, and governance roles.

Mechanism of creating and the lifecycle of tokens

Token creation begins by yet defining its purpose, name, supply and rules with the help of a smart contract. Tokens may have a fixed or inflation supply. After they are launched, they go into circulation and users trade them, stake them, or use them for fees. Lifecycle ending with a burning or expire to manage the supply. Security audits and compliance with regulations make sure that is safe and that it complies with the rules.

Flow for Smart Contracts Deployment

Smart contracts are deployed on blockchains to execute code in a way which is secure and unchangeable. Developers write code using Solidity (Ethereum) or Rust (Solana) and compile them into bytecodes and an ABI for app interaction. Deployment costs are between $200 – $400 on Ethereum, Polygon and Solana, under $1.

Contracts are first deployed to networks such as Sepolia for testing before being deployed with a unique address. Verification through explorers such as Etherscan is the way to banter the transparency. Walmart uses smart contracts on food traceability, reducing mango food tracking from 7 days to 2.2 seconds.

Verification, Issuance, and Circulation

Tokenization turns real-world assets into blockchain tokens through three steps: verification, issuance, and circulation. Verification to prove ownership, value appraisal and audit reserve. For example, a $10M building is verified by PwC, and custodians to ensure 100,000 tokens to the asset. Legal compliance, like titles or SEC/MiCA rules, is checked before issuance.

Issuance involves creating the tokens on Ethereum or Solana via smart contracts and structuring through an SPV. Passing KYC/AML, investors are able to purchase fractional tokens, e.g. $100 each. Tokens are traded on exchange platforms such as Uniswap or Coinbase with smart contracts automating payments or dividends. Redemption allows to burn tokens which keeps supply matched with the asset, thus alkali supply and transparency.

Real-World Applications of Tokenized Assets

Tokenization transforms and turns physical or financial assets into digital tokens on a blockchain, thus ushering in tradable and verifiable ownership. By 2025, the on-chain real-world asset (RWA) market grew over $35 billion, which facilitated quicker settlement and fractional ownership of property.

Financial products such as U.S. Treasures and corporate bonds are now settling in seconds. Real estate sites such as RealT allow investors to purchase shares of real estate for as little as $50. Commodities like Tether Gold (XAUT) offer the 24/7 trading of physical gold. Art, micro finance and carbon credits are also tokenized, enhancing liquidity, transparency and efficiency at the global level.

Currency-Pegged Digital Units

Stablecoins are cryptocurrencies that are pegged to fiat currencies such as the US dollar and have stable values. By the late 2025, the market reached $306 billion with a $33 trillion in transaction volume.

Fiat-backed: This tends to rise and likely increases the price reserved stablecoins, such as USDT and USDC, with 87% of the supply kept in reserve. Crypto-backed stablecoins like DAI have over-collateralized assets and smart contracts in place.

Algorithmic models base supply on code but are still dangerous as seen in the collapse of TerraUSD, which lost $45 billion dollars. Tether and USDC lead in terms of usage considering trading and cross-border payments among others; liquidity and trust.

Property Fractionalization Models

Real estate fractionalization takes property ownership or income and converts it into digital tokens, which makes it possible for many investors to have portions of high-value assets. Platforms such as RealT and AI investment companies such as Lofty AI are making investments as low as $100, making it easier for investors to enter the market. This model allows for retail and/or institutional involvement in previously illiquid property markets.

Core models include the direct equity tokenization, an SPV based tokenization where the tokens represent shares in a legal entity, and a tokenized cash flows granting revenue rights without ownership. The debt-based and basket tokenization to spread risk or the tie tokenization of tokens to loans based on property.

Smart contracts are being used to automate dividends, required holding periods and maintenance work and ensure there is compliance, oracles checks real-time data such as appraisals to ensure it’s accurate. The market is expected to grow to $1.5 Trillion by 2030.

Debt Instruments on Blockchain

Tokenized debt is a blockchain representation of bonds, loans, and commercial paper that improves the speed and costs of access and allows fractionalized access. As of January of 2026, U.S. Treasuries tokenized stood at $8.8 billion versus $18.7 billion in private credit. Platforms such as HSBC Orion and Ondo Finance facilitate issuances, with the ability in settlement closer to near-instantly (T+0) and lower costs by up to 40%.

Major issuers are BlackRock’s BUIDL fund ($2.8 billion AUM), World Bank (CHF 200 million bonds), EIB (100 million Euros), J.P. Morgan (US commercial paper). Tokenization makes units as low as $100, making it easier for small investors to invest.

Art, Media, and Intellectual Rights

Tokenization turns art, media, and IP ownership into digital tokens, making high-value assets accessible and tradable. By early 2025, the tokenized IP market was worth $12 billion with fractional ownership meaning that $10 million artworks could be divided into thousands of tokens. Smart contracts automate the process of royalties and cut down on overhead costs by as much as 70%, as well as improve liquidity by allowing 24/7 trading.

Some notable examples are Picasso’s painting decentralized into 4,000 Art Security Tokens by Sygnum, Nas selling song royalties on Royal.io and IBM turning 25 million patents into NFTs using IPwe. Tokenization is also funding movies such as Braid (1.4M), enabling access to sports experience, and turning old markets into global accessible digital ecosystems.

Gaming Economies and Virtual Items

Tokenization involves converting in-game items into NFTs, which allows players to actually own and trade their items. The market for blockchain gaming is predicted to expand from $13 billion in 2024 to $301.53 billion in 2030, at 69.4% compound annual growth rate. Players keep assets even when a game shuts down, and secondary-marketplaces, such as OpenSea, allow players to trade assets at real world value.

Popular examples include Axie Infinity with more than 2 million active daily users in 2024, The Sandbox and Decentraland where virtual land is tokenized or Gods Unchained where NFT cards can be exchanged for free. Tokenization allows for play-to-earn models and cross-game interoperability, allowing players to monetize their gameplay and transfer their assets across virtual worlds.

Benefits Driving token-based markets

Token-based markets indicate a structural transformation in global finance. As of the present time, tokenized real world assets amount to almost $300 billion in 2024. Moreover, projections indicate that it will grow between $2 trillion to $30 trillion by 2030. Therefore, these markets are getting a huge attention from the institutions and the investors from all over the world.

Increased Speed of Settlement Infrastructure

Tokenization is for more rapid settlement structure across the globe. In addition, atomic settlement enables an asset and payment to exchange at the same time. As a result, the days in which a settlement period is required become much shorter (from T+2 days to minutes). Consequently, capital becomes immediately available, improving liquidity management and increasing capital velocity for institutions worldwide.

Improved Market Depth

Tokenization adds value by increasing market depth (increased asset access). Moreover, fractionalization splits illiquid assets into smaller units of the digital sphere. For example, a $100 million piece of property can be divided into 1 million tokens. As a consequence the secondary market activity is up to 50% as 24*7 trading allows constant price discovery and more ease of participation by investors.

Operational Cost Efficiency

Asset tokenization on Blockchain helps in saving the operating cost of financial markets. Smart contracts are used to automate dividends, interest calculation and coupon payments. This reduces the manual effort and processing delays. Eliminating brokers and clearinghouses means less reconciliation needs. As a result, institutions may lower operational costs by almost 30% to 70%.

Investor Accessibility Expansion

Tokenization makes investors more accessible in the global markets. Lower barriers to entry making it possible for wider participation in elite classes of assets. For example, private equity minimums had declined from $5 million to almost $500. Blockchain networks are borderless, and this means that issuers are not restricted by traditional cross-border settlement barriers, allowing them to reach global investors.

Audit-Friendly Transparency

Aspect of Asset tokenization is to improve the audit-friendly transparency of digital assets. Immutable ledgers. Every transaction is recorded on the tamper-proof blockchains. This creates a single verifiable source of ownership history. Compliance rules such as AML and KYC are hard baked directly into tokens. As a result, auditing and reporting is done in real time with greater accuracy.

Risks and Barriers Facing Token Adoption

As of 2026, in the various global markets, there are serious barriers to token adoption. Security losses were at record levels all over the world. Compliance penalties rose to the level of multi-million dollars. At the same time, there are still fragmented global legal frameworks. These combined pressures still trickle down to slow institutional and retail adoption.

Regulatory Fragmentation Challenges

Regulatory fragmentation is a major challenge for market of tokens. Despite such progress as the EU MiCA framework and the US GENIUS Act, the level of alignment has been limited. Around 45% of crypto companies say that they have cross-border rules as their biggest concern. This figure rose from 38% in 2023.

Operational friction was also on the rise for 2024. Around 54% of global exchanges suspended operations in at least one jurisdiction. These suspensions were forced by regulatory uncertainty. As a result, continuity of the markets suffered in several regions.

Infrastructure Vulnerabilities

Vulnerabilities in infrastructure grew in the digital asset platforms. The year 2025 became the worst recorded for theft. Around $1.93 billion was taken in the first half alone. Total losses in a year amounted to between $2.7 billion and $4 billion.

Losses were highly concentrated at great incidents. The $1.5 billion Bybit breach accounted for close to 69% stolen service funds. This is one event that pointed out systemic risk exposure.

Compliance and Reporting Burdens

Compliance costs increased sharply across exchanges. The average annual compliance expense reached $4 million. This was a 27% increase earned year over year. Mid-sized exchanges would frequently spend more than $500,000 each year on AML and KYC systems.

Enforcement actions also increased around the world. The median AML fine was up to $12 million for 2025. In the US, the SEC determined more than $1.69 billion in cumulative penalties. These actions increased the pressure of operations.

Tokenization in Private and Institutional Markets

Tokenization is modifying private and institutional markets using blockchain technology. Digital tokens are a representation of ownership and enhance liquidity, transparency and efficiency.

The tokenised asset market expanded from $4 billion in December 2019 to more than $331 billion in November 2025. This includes stablecoins with an 8,175% increase. The market has a potential of reaching $2 trillion to $16 trillion by 2030.

Cross-Border Trading Enablement

Tokenization allows one to quickly and economically trade across borders. Assets can be traded 24/7 across the world and more investors can access it. Stablecoins are fast-acting and agile banking fees. Using tokens versus actual data to make the data more secure This helps reduce fraud, which costs banks $15 – 20 billion every year.

Clearing and Settlement Optimization

Tokenization reduces a transaction from taking days to just a matter of minutes or seconds. Smart contracts help in automating payments such as dividends and interest. As a result of this, efficiency can be improved even by 40%. Immutable ledgers eliminate duplicate ledgers.

Institutional Custody Integration

Tokenized assets require special custody collaborating with reporting and risk systems. About 24% of institutions made plans to make major purchases in 2025. Funding for crypto custody has increased from $471m in 2020 to $3.5bn in 2021. Custody solutions are audited and have segregated accounts to ensure tokenized assets.

Public Versus Permissioned Token Networks

In 2025, the hybrid Free and permissioned token networks were popular for use in the corporate environment. Businesses are concerned with speed, privacy, and regulatory compliance. Public block Chains share 52% of the market in 2024.

Permissioned networks are expanding at a faster rate with 67% CAGR. They process thousands of transactions every second. Public networks are pseudonymous whereas permissioned systems would ask for verified identities.

Enterprise-Controlled Ledger Use

Enterprises are using permissioned ledgers for critical workloads. As of 2025, 48 Fortune 100 companies have hybrid or permissioned networks. The market for enterprise blockchain continues to expand at a very fast thanks to a robust advancements network. Enterprise blockchain market increased from 9.64 billion dollars in 2023 to a projected 145.9 billion dollars by 2030. BFSI ahead in use with some of the platforms used – JPMorgan Onyx – for real-time settlements.

Transfer Rules and Access Controls

Permissioned ledgers have very strict governance and access control. Administrators allocate roles such as validator or read only. Attribute-Based Encryption restricts access to data for authorized users. Smart contracts are used to automatically enforce rules. Privacy tools such as Zero-Knowledge Proofs and Fully Homomorphic Encryption make it possible to securely analyze without revealing sensitive data.

Strategic Impact on Investment Models

Asset tokenization is transforming investment and the market. The market for规ies WRA (on-chain) increased to more than $24 billion in mid-2025. Market projections predict tokenized assets will by 2030 be worth 16 trillion dollars. Strong industry adoption is evident given that major financial institutions-on the lines of BlackRock and JPMorgan-have progressed from testing to the full-scale implementation phase.

Efficiency and Cost Reduction

Blockchain and smart contracts optimize operations at a lower cost. Asset managers could reduce operating expenses by as much as 23% at a total of $135.3 billion. Transaction costs are reduced by 35% – 65% and real estate transactions can be expedited by up to 80%.

Settlement takes place in minutes or seconds as opposed to one to two business days. Fund launches reduce from 12 weeks to 9 weeks with a decrease in seed funding of 24% ($12.2 million).

H3 Portfolio Construction and Liquidity

Tokenization allows fractional ownership, the minimum investments being as low as $50-$100. This opens up markets, which previously were accessible only to wealthy individuals and institutions. Trading in the secondary market is done 24*7, and market liquidity is increased by 15%-25%. In mid-2025, private credit accounted for 58% ($14 billion) of tokenized RWAs, while U.S. Treasuries accounted for 34%. Tokenized Treasuries increase 539% January 2024 – April 2025.

Forward Outlook for Blockchain-Based Assets

Blockchain based assets are fast growing and transforming the finance world. The tokenized mining potential of RWA could be worth $9.4 trillion to $16 trillion in 2030. Institutions are increasingly adopting digital assets as part of the core operations, driving efficiency, speed and cost saving across markets.

Regulatory Maturity Expectations

Regulatory clarity helps increase institutional adoption. Some 80% of jurisdictions introduced new activities in 2025. The EU’s framework for MiCA and stablecoin rules, lower heat: Aid compliance Smart contracts combine AML and KYC. Still 56% of leaders identify the uncertainty of regulation as a key hurdle.

Financial Infrastructure Transformation

Digital assets serve as core infrastructure when it comes to finance. BlackRock’s BUI has $2.9 billion, JPMorgan’s Kinexys has $2 billion processed daily. Tokenization allows 24/7 trading, reduces costs by 35% – 65% and settles transactions within minutes. Savings in middle and back offices are 22% and potential is up to 85% by 2028. Over $30 billion is locked over RWA platforms.

Frequently Asked Questions About Tokenized Systems

Motivation of Digital Asset Conversion

Tokenization shifts value from physical certificates and silos databases to shared and programmable ledgers. It enables almost instantaneous settlement and saves between 35% – 65% administration costs. Smart contracts are used to automate transactions such as dividend payments, interest and regulatory reporting.

Asset Eligibility for Blockchain Representation

Assets that can be tokenized include stocks, services, and physical assets. U.S. Treaseries, private credit, corporate bonds, and mutual funds are commonplace. Real estate, fine art, gold and collectibles also qualify. Intangible rights are those relating to ups such as IP, music royalties, carbon credits and future service access.

Liquidity Creation Through Token Markets

Tokenization leads to higher liquidity of static assets. Fractional ownership reduces estate entry barriers such as dividing a $10 million property into $1,000 units. Markets run 24X7 and investors can take action anytime. Secondary markets allow investors to exit early from positions in either private equity or venture positions.

Long-Term Asset Management Benefits

Institutions apply tokenization purposes for growth and stability. The market has the potential to be $2 trillion to $16 trillion in 2030. Custom portfolios are easier to create. Blockchain helps to guarantee transparent ownership history, which means fewer scams related to high-value commodities such as art and diamonds.

Conclusion

Asset tokenization on blockchain has been revolutionizing the way finance operates around the world by making assets faster, cheaper and more accessible. It creates more transparency, combats fraud and accommodates fractional ownership of high-value assets.

With smart contracts automating processes and markets running 24/7, investors gain more flexibility and efficiency. Overall, tokenization is shaping a secure, liquid, and borderless digital economy for the future.

FAQs

What is tokenization in NLP?

Tokenization in NLP means breaking text into smaller parts, like words or sentences, so computers can understand language.

What is tokenization in banking?

In banking, tokenization replaces sensitive data with secure tokens to protect customer information.

What is tokenization in blockchain?

Tokenization in blockchain converts real or digital assets into tokens that can be stored and traded on a blockchain.

What is tokenization in crypto?

In crypto, tokenization represents assets or rights as digital tokens that can be transferred on blockchain networks.

What is tokenization in finance?

Tokenization in finance turns traditional assets into digital tokens, making them easier to trade and manage.

What is tokenization in AI?

Tokenization in AI helps systems process data by breaking text or information into manageable pieces.

What is tokenization in payments?

Tokenization in payments secures transactions by replacing card details with unique digital tokens.

What is tokenization example?

Tokenization is converting a property into digital tokens so multiple investors can own small shares.