Learn what a Token Generation Event (TGE) is, how it works, benefits, and key insights for crypto investors.

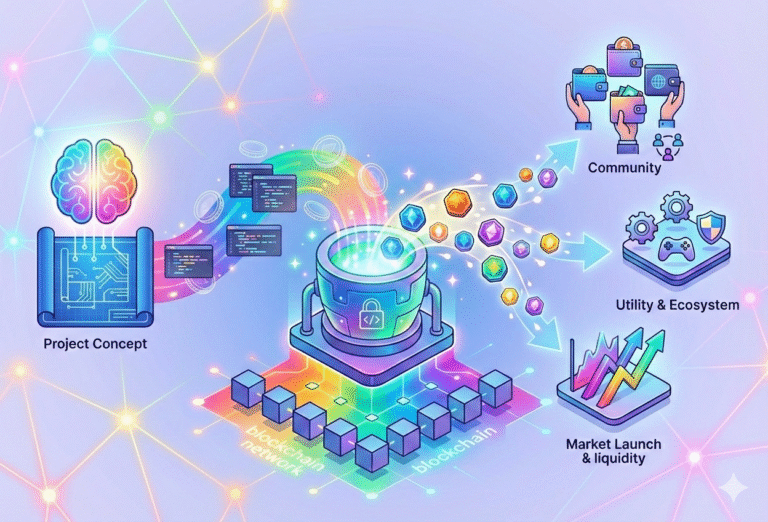

A Token Generation Event (TGE) in crypto marks the official moment a project creates, mints, and initially distributes its native digital tokens to the public. This event basically means the beginning of a token going out into the wider market and hence becoming available for use, trade, or participation in the project’s ecosystem.

Key Takeaways

A Token Generation Event (TGE) is when the project generates and releases its tokens to the public. TGEs concentrate on using the tokens for something real, such as governance or access to the platform, rather than just to make money. They include audits, vesting schedules, and airdrops in order to protect investors and build strong communities.

TGEs are safer than old ICOs, and have retail and institutional participants. Research, wallet security and following rules are important. Successful TGEs incorporate clear token plans, good liquidity, and active communities to grow and offer real value to be used to ensure long-term project success.

Introduction

A Token Generation Event is imposed when a new token is introduced on a blockchain and comparable to making the token accessible to the public in early stages. During a TGER, projects sell tokens to raise funds and create an initial community.

However, unlike ICOs, TGEs are more technical readiness and real utility. Therefore, it is important to understand TGEs to help investors gauge credibility, functionality as well as long term ecosystem growth before active participation in the global market.

Understanding Token Generation Events

A Token Generation Event (TGE) is an official event to launch a blockchain token, and distribute this token to the public. In 2026, TGEs are occurring on networks such as Ethereum and Solana. They concentrate on utility and governance and raise capital, some aiming at millions of users.

For instance, Orbiter Finance (OBT) TGE was planned on January 20th 2026, Animecoin (ANIME) on January 23rd 2026 and Zama (ZAMA) on February 2nd 2026. TGEs are frequently accompanied by airdrops, smart contract audits, and vesting schedules. Average token allocations are 10-30% for early investors and there are projects with total supplies of more than 100 million tokens.

Types of Crypto Tokens

Crypto tokens are digital assets that are based on blockchains. They have varying purposes ranging from being of use on a platform, to the ownership of real-world assets. Most tokens can be divided into three categories: utility, security or governance. Some newer tokens are a mix of both, but classification is based on primary purpose and role in their ecosystem.

Utility Tokens

Utility token is used as a key to access services in blockchain platforms. They are not built as money such as Bitcoin. The market cap of cryptocurrency saw the total value of $3.40 trillion by the end of 2024, and utility tokens were behind most decentralized applications. Some examples are Filecoin for paying for storage, BAT for Brave and Chainlink for node operator compensation.

Security Tokens

Security tokens are the representation of ownership of real-world assets such as real estate, gold or equity. The global market for STO is estimated to be worth $382 million in 2024, and it could be worth $1.27 billion by 2031. Real estate accounted for 35% of the market and on-chain US Treasuries surged from $760 million to $2.6 billion, indicating a quick adoption.

Governance Tokens

Governance tokens allow their holders to have the right to vote in DAOs. The top governance tokens had a $12 billion market cap at the beginning of 2026 and $5.8 billion in daily trading volumes. Users vote for upgrades, fees and allocation of the treasury. Popular examples include Uniswap (UNI) and Aave (AAVE) which give holders the ability to directly influence decisions about the protocol.

How Token Generation Works

A Token Generation Event (TGE) is when a blockchain project issues its native tokens and distributes them to investors, early backers and the community. Unlike mining, which involve the use of computation and in this case, TGEs involve the use of smart contracts to create a fixed or capped supply. Modern TGEs are highly structured, in that there is a combination of technical execution and financial planning.

Token generation runs a smart contract, typically ERC-20 or BEP-20, which specifies the characteristics of the token. About 90% of TGEs have a hard cap to avoid dilution. Most projects have vesting schedules in which many times a 1-year cliff is implemented with 3-year monthly release for critical teams. Many also give 5-15% of the tokens to early users through airdrops, to disperse ownership.

TGE vs ICO: Key Differences

Purpose and Timing

Initial Coin Offerings (ICOs) were mainly meant to raise capital for projects that were in their early development stages, and often before they had products that were operational. About 90% of ICOs in 2017-2018 – pre-product. In contrast, TGEs, where the product is 80-100% ready, have a utility and ecosystem focus, focusing not on fund raising. T

Risk and Compliance

ICOs raised $21.4 billion in the year 2017-2018 but had a high failure rate with 80% of them labeled scams or failures. TGEs emphasize consumptive use of tokens so that it can evade classification as securities under the Howey Test.

Reputable TGEs now integrate KYC for almost 100% of the participants. Institutional capital movement shifted as well, with more than $13 billion flowing to compliant TGEs and tokenized real-world assets. Launchpad-based TGEs have better survival rates than ICOs.

Token Structure and Vesting

In 2026, tokenomics has become a structured system for reducing volatility and aligning the long-term incentives. Strategic vesting, distribution planning, and liquidity management are now the norm for all blockchain projects. These measures are helpful in protecting the investors, maintaining the stability of the market and for sustainable growth.

Distribution Models

Modern token distribution balances the needs of the teams, investors and communities and maintains decentralization. Core teams typically receive 15-20% of the supply, with mature projects such as Near Protocol having 14%.

Early investors are often rewarded 17-25%, with the remaining amount, generally 40-60% for community rewards, staking and grants. Ecosystem and treasury allocations are 10-20% for long term growing.

Vesting Schedules

Vesting stops early holders dumping tokens to ensure that the market behaves in an orderly manner. Standard periods 4 years with cliff 1 year After the cliff of 25% of tokens are unlocked, there are linear monthly unlocks over 36 months.

In 2025, more than $97.43 billion of tokens were released as projects reached unlock milestones. Institutional TGEs are now using audited smart contracts that are transparent to the public via the blockchain.

Liquidity Management

Liquidity is the number of tokens that projects will allocate as liquidity. 10-15% is generally allocated for liquidity. Ethereum is the DeFi leader with 56.8% of the total value locked while stablecoins account for 44% of crypto trades.

Tether (USDT) has $104 billion of circulating supply. Top exchanges such as Binance control 36% of the liquidity all over the world, which has the average Bitcoin spread of 0.02%, a highly efficient market.

Market Impact of TGEs

In 2026, Token Generation Events (TGEs) show a shift from retail speculation to institutional de-risking. Launches still introduce new assets, but “launch-day pops” are rare. Over-saturation and short-term profits trading have led many projects to get sold off immediately, limiting short-term gains and making the market volatile.

Initial Launch Effects

Recent TGEs have underperformers as markets absorb immediately after launch. In late 2025, 84.7% of 118 major tokens were trading below their issue price. The median fully diluted valuation (FDV) declined by 71%, and median market capitalization declined by 67%. Only 15% of projects showed positive returns after being launched. Airdrop farming and mercenary capital was the cause of systematic sell pressure and early liquidations.

Liquidity & Price Discovery

Liquidity is no longer concentrated in centralized exchanges (CEXs). By the middle of 2025, the volume of DEX-to-CEX spot trading rose to 20-25%, indicating a shift towards on-chain venues, such as Uniswap V4.

However, CEXs such as Binance are still the largest and continue to have roughly five times the spot volume of their competitors. Bid-ask spreads on CEXs are currently averaging 0.04% compared to 0.12% on DEXs. Institutional inflows, such as over $1 billion of ETF investments in early 2026, now play a major role in price discovery.

Benefits of the Token Generation Events

In 2026, a new type of launch that will be structured as a Token Generation Event (TGE) where utility, compliance, and community engagement are the measures of success: Modern TGEs offer value to the combination of functional design, transparency and strong network effect, as they help to build long-term sustainability for projects that are attractive to both retail and institutional participants.

Utility Design

Tokens are now used for more than just speculation. Over $3.5 billion went out to people who held the tokens through protocol fee-sharing in early 2026. Projects such as Render (RNDR) and Filecoin (FIL) use tokens for coordinating global resources. About 25% – 30% of the circulating supply is frequently staked for securing networks, which means such yields of 4% – 9% per year for the case of major Layer-1 protocols.

Transparency and Regulation

TGEs have replaced the ICOs that are not regulated by government in the form of compliant frameworks. Public smart contracts allow investors to check team allocations through Etherscan to minimize chances of fraud. Over $13 billion in institutional capital has been invested in Reg D and Reg S-compliant TGEs. Most projects undergo at least two independent audits which helps in initial liquidity retention by around 40%.

Community Growth

TGEs achieve powerful network effects as a result of converting users into stakeholders. Average airdrop allocate of 7-12% can create 500 000 + active wallets in 24 hours. Governance tokens give power to more than 10,000 DAOs with $40 billion in treasury. Global participation is strong and 35% of unique wallet interactions during major TGE launches are from Southeast Asia and Africa.

How to Participate in a TGE

Participating in a 2026 Token Generation Event (TGE) is a carefully planned, secure, and regulatory process. So, the key to success is research, technical preparation, and managing the risks – to navigate the volatile markets and protect your funds.

Research and Preparation

Thorough due diligence is critical in TGE success. Carefully analyze the whitepaper, keeping the team allocations below 20% and the community or ecosystem allocations at more than 50%. Verify at least two independent audits from companies such as CertiK or Hacken that lower the chances of failure by 40%. Track social engagement via LunarCrush; good TGEs tend to have a Galaxy Score of >70/100 prior to launch.

Wallet and Security Setup

Security- Security is critical, as hacks of crypto-$1.9 billion of losses occurred in 2024. Don’t use an exchange wallet or a custodial hardware wallet such as Coinbase or Binance; instead, use non-custodial hardware wallets such as Ledger or Trezor.

For high risk dApps, use a “burner wallet” with very little money in it. After the TGE revoke unlimited permissions using Revoke.cash to avoid subsequent exploits.

Compliance Requirements

Anonymous participation is no longer possible to a large extent because of the global regulations. About 95% of TGEs are now requiring KYC verification using providers such as Sumsub. Some TGEs limit the area of residence to the U.S., China, or North Korea. High-value Reg D TGEs could also need accredited investor status, net worth over $1m or income over $200K.

Risk Management

Market dumps are widespread following the TGE. In 2025, 84.7% of tokens sold below their launch price in less than 90 days. Experts recommend only allocating 1% – 5% of a cryptocurrencies portfolio per TGE. Track token unlock schedules – large unlocks can cause a 15 – 20% spike in the price of the token in the next 48 hours.

Success Factors for TGEs

In 2026, TGE success is not measured as the initial capital raised but post-90 day retention. Over $100 billion in tokens were unlocked in the last 18 months underscores the importance of having robust technical, legal, market and community frameworks for long-term survival.

Technical Readiness

A perfect launch creates investor confidence. Projects having 3+ audits retain 55% more TVL. Mainnet simulation will process 50,000+ TPS without network congestion. Decentralized RPC providers such as Pocket Network guarantee 99.9% uptime during peak minting times and minimize slippage and technical downtime that plague legacy launches.

Legal Compliance

Regulatory compliance is attractive to 3.5x more institutional capital. MiCA adherence is mandatory in exchange listing – EU. Projects use consumptive utility to design tokens to avoid being SEC securities. Automated KYC through Sumsub helps to expedite participant onboarding by 30% as compared to manual verification.

Market Strategy

Strategic FDV management helps avoid crash day at launch. Successful TGEs are in the range of the FDV:market cap ratio of < 5:1. Allocating 10%+ of supply to liquidity pools keeps slippage below 0.5% for $100k trades. Relating team cliffs to project milestones helps alleviate sell pressure and makes the tokens more long-term.

Community Engagement

“Sticky communities” outperform short-term airdrop farmers. Early adoption of DAO leads to a 40% increase in organic mention and developer contributions. Successful TGEs keep churn less than 35% for the first 30 days. Pre-launch education via various platforms such as Galxe or Layer3 helps to triple airdrop hold times and solidify long-term engagement.

Ecosystem Use Cases

In 2026, token use has been transformed from single apps to fully connected ecosystems. Bitcoin’s network and institutional tokenization is now responsible for decentralized finance and global adoption of blockchain. Projects combine a variety of protocols to establish scalable and interoperable financial and infrastructure systems for efficiency and access to users.

Bitcoin Interoperability and Utility of the Network

Bitcoin is not just a store of value BTCFi obtained $22 billion TVL by early 2026 by using Layer-2 solutions such as Stacks and Rootstock. BitVM support to use $4.5 Billion in BTC as collateral for loans without leaving Bitcoin. Runes and Ordinals raise $750 million from fees. Liquid staking platforms such as Babylon offer yields ranging from 3.5% – 5% and keep tokens liquid.

Institutional Tokenization Platforms

Institutional tokenization is on an explosive growth. Tokenized U.S. Treasuries increase 320% in 2025 to $3.8 billion. Settlement times were reduced from T+2 to near-instant T+0, saving banks $15 billion a year. Private credit tokenization exceeded $10 billion, under 2.1% default. About 45% of institutional tokenization is on hybrid or public blockchains that are subject to EU and UK regulations.

From Protocol to Ecosystem

AppChain and Superchain models are used in the place of single blockchains for horizontal scaling. Compared to the mainnet, Ethereum L2s handle 15x more transactions. Optimism Superchain and Arbitrum Orbit have more than 1,200 chains. Uniswap’s $2.4 billion treasury is used for developers. LayerZero & Chainlink CCIP manage $12 Billion in monthly cross-chain transfers for better interoperability across web3 ecosystems.

Future Prospects of Token Generation Events

In 2026, we’re seeing a transition of Token Generation Events (TGEs) from retail speculation to the institutional world. About 59% of institutions will have digital assets in their portfolios. New rules in the U.S. and EU will help provide clarity of where to go and 86% of institutional investors already hold or plan to invest in crypto.

Technology will also influence TGEs. AI agents will accelerate the launch of tokens, and DeFi protocols will automatically handle risk. Energy efficient networks and tokenized real world assets will increase, hitting $500 billion. Global crypto users could reach 994 million, and the average price of Bitcoins could hit $130K, which will be an important year for crypto adoption.

Conclusion

Token Generation Events (TGEs) allow projects to introduce tokens in a safe and useful manner. They are focused on real use, security and developing communities. Unlike the old ICO, TGEs abide by rules and have long-term growth plans. Careful research, wallet security and risk management help investors join safely while supporting strong and lasting blockchain projects.

Crypto FAQ: Token Generation Events (TGE)

Q1: What does TGE in crypto mean?

A TGE is when a project creates and distributes its native token to the public.

Q2: What is the difference between airdrop and TGE?

Airdrops give free tokens, while TGEs officially launch and sell tokens.

Q3: Is TGE the same as listing in crypto?

No, listing happens on exchanges after the token is created and distributed.

Q4: What is the difference between TGE and ICO?

TGEs focus on ready products and utility, while ICOs often raised funds pre-product.

Q5: What are some successful TGE examples?

Orbiter Finance (OBT), Animecoin (ANIME), and Zama (ZAMA) are recent TGEs.

Q6: How does Binance TGE work?

Binance conducts token sales through Launchpad, letting users buy new tokens early.

Q7: What is Elon Musk’s favorite crypto coin?

He has publicly mentioned support for Dogecoin (DOGE).

Q8: What is the 1% rule in crypto?

Invest no more than 1% of your total portfolio in a single crypto asset.

Q9: Which crypto will 100x in 5 years?

No crypto can be guaranteed to 100x; growth depends on adoption and utility.

Q10: What are the benefits of a TGE for crypto projects?

TGEs raise funds, build communities, and distribute tokens for ecosystem use.

Q11: How to know coins before listing?

Track project announcements, Launchpads, and verified whitepapers for upcoming tokens.

Q12: What is TGE airdrop?

It is a distribution of a small portion of TGE tokens to early supporters.