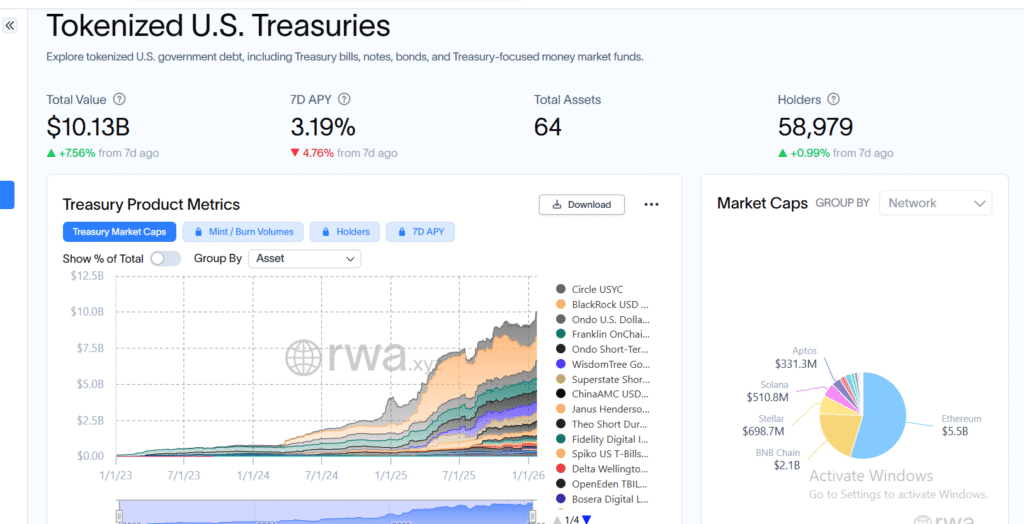

Tokenized U.S. Treasuries surpass $10.13B as institutional demand and blockchain efficiency accelerate digital bond adoption globally.

Tokenized U.S. Treasuries reached a historic milestone by January 24, 2026. The market surpassed $10.13 billion after a 7.59% rise within seven days. This growth shows an increase in confidence in financial instruments based on blockchain. Investors are more and more interested in tokenized assets because of their transparency, efficiency, and 24/7 market access.

Tokenized Treasury Market Reaches New High

The market now has 64 tokenized Treasury assets and almost 59,000 total holders. Ethereum is the market leader with a capitalization of $5.6 billion. Meanwhile, BNB Chain is holding $2.1 billion confirming good multi-chain involvement. Stellar is also still relevant, holding around $0.6987 billion in tokenized Treasuries.

Other networks are still gaining ground as a growing number of people adopt them. Solana is about $0.5108 billion, and this is because of increased demand for faster settlement.

Aptos comes next with about $0.3313 billion giving evidence of gradual experimentation in the institutional realm. Avalanche C-Chain holds almost $0.2384 billion, whereas Arbitrum holds about $0.1991 billion in value.

Related Reading: What Is Asset Tokenization on Blockchain? Fundamentals and How It Works – Ledger Tribune

Product leadership is still concentrated in several major issuers. Circle International’s USYC is the leader with a market cap of $1.69 billion. The product has a 7-day APY rate of 3.01%. However, Binance reportedly owns around 94% of the supply in circulation, which means that it’s highly concentrated.

BlackRock’s BUIBuild is close behind with $1.68 billion in assets under management. The fund focuses mainly on institutions – with a minimum of $5 million to invest. Although its holder base is more diversified than USYC, participation is still mainly institutional.

Institutional Demand Shapes Market Outlook

Ondo Finance’s USDY offers a wider access than other products. USDY has about $1.20 billion in value and is aimed at retail investors outside the US. It currently counts more than 17,000 holders. As a result, USDY’s focus is on increasing retail access to tokenized Treasury markets.

Market growth is mainly due to institutional interest as well as blockchain efficiency gains. Tokenized Treasuries enable 24/7 issuance, trading, and redemption to take place on-chain. This structure is a great improvement over traditional settlement systems which often need T+1 or more timelines. Therefore, liquidity and operational flexibility increase in a substantial way.

Another important driving factor is yield generation and collateral utility. Tokenized Treasuries are government-backed yield with programmable capabilities. These assets are increasingly becoming collateral in decentralized finance platforms.

Strategic views from major asset managers are additional support for expansion expectations. BlackRock and others say tokenization is a signature financial trend for 2026. Executives say future tokenized offerings may go beyond Treasuries and into broader asset classes. As a result, market participants are looking forward to continued growth in the future.