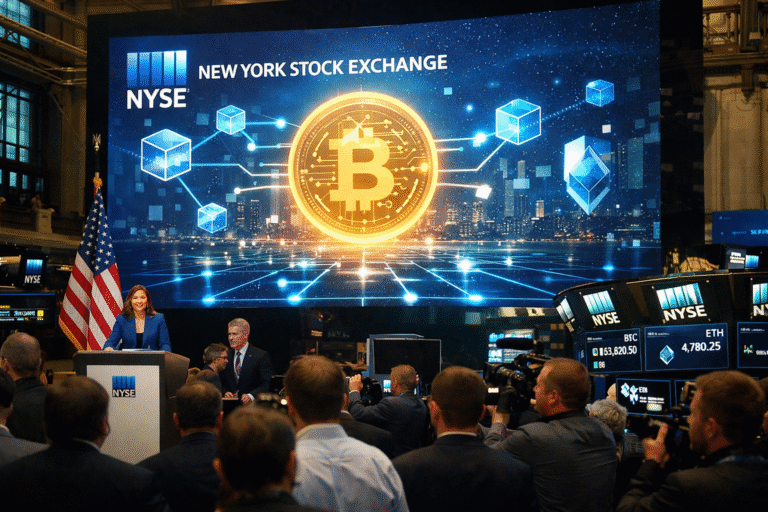

NYSE announced a new tokenization platform featuring 24/7 trading, instant settlement, and stablecoin funding, marking a major shift toward onchain equities.

The New York Stock Exchange has announced plans for a new tokenization platform focused on digital securities. The initiative launches a completely separate trading venue. Consequently, NYSE declared its dedication to the traditional and onchain markets for the long run.

NYSE Plans Parallel Exchange With 24/7 Onchain Trading

According to the announcement, the new platform will be independent of the existing exchange. Trading will be 24/7 without having fixed hours of the market. Settlement will take place on an instant basis instead of employing the T+1 model.

This is bullish for crypto, and crypto exchanges. https://t.co/zqCOlbBW7V

— CZ 🔶 BNB (@cz_binance) January 19, 2026

Funding on the platform will be based on stablecoins rather than the earlier bank wire transfers. In addition, securities will be natively released as digital assets. Therefore, NYSE is not retrofitting blockchain into existing systems.

Related Reading: What Is Asset Tokenization on Blockchain? Fundamentals and How It Works – LedgerTribune

The current NYSE will keep going as usual. It will keep trading hours from 9:30 to 4:00 EST. Settlement will still be on a T+1 basis using traditional banking rails.

In contrast, the new venue brings with it continuous trading and onchain settlement. Both systems will be running in parallel. As a result, NYSE is not taking a choice regarding traditional vs. digital models.

Binance’s founder Changpeng Zhao offered a public comment on the development. On X, he called the move bullish for crypto markets. His comments reflected the rise in institutional acceptance of tokenization.

The announcement puts NYSE in a different position than other providers of financial infrastructure. Many competitors have focused on tokenizing existing assets. NYSE is instead developing a new venue and issuance model at the same time.

DTCC has focussed on tokenization of already custodied securities. State Street has been involved in tokenized money market funds and ETFs. Nasdaq has made changes that would allow for tokenized trading to be possible along with the traditional system.

However, NYSE is going for native digital issuance and trading together. This way it puts it in more direct competition with platforms such as Figure’s OPEN and Superstate. In turn, the competitive landscape may change.

Tokenized Equities Signal Structural Market Shift

Tokenized stocks allow for such settlement on blockchain networks. There is the possibility of custody in digital wallets instead of centralized depositories. Therefore, a reliance on legacy clearing systems could reduce.

Onchain trading also eliminates the traditional hour markets. Trading never needs to stop. This structure would change liquidity patterns and global participation.

Capital formation may also be subject to change under this model. Issuance and settlement can be done through stablecoins. As a result funding processes could be made faster and more accessible.

The announcement raises larger questions for financial institutions. Many firms are currently in a process of digitizing existing operations. Others are creating systems to eventually replace them.

NYSE seems to be doing both simultaneously. By having parallel exchanges, it does not disrupt legacy revenue while looking into the future. Therefore, the strategy mitigates transition risk.

Market observers say regulatory clarity is key. Digital securities still need to comply with securities laws. However, NYSE’s involvement may be more proactive in driving regulation.

The move is also a sign of confidence in stablecoin infrastructure. The use of stablecoins for settlement implies trust in the reliability of using them. This may further legitimize the use of stablecoins in the capital markets.

Institutional adoption of tokenization has increased in the last few years. Asset managers and custodians have been running several pilots. NYSE’s move is a major step up.

NYSE Prepares for Tokenized Future Without Abandoning Legacy Systems

By establishing a completely separate venue, NYSE is not restricted by legacy systems from a technical point of view. This makes for design flexibility from the ground up. As a result, innovation may be faster.

The development signals a more general industry inflexion point. Traditional exchanges are no longer digital finance bystanders. Instead, they are active builders.

For global markets, the implications are not just for equities. Onchain infrastructure could have a bearing on bonds, funds and derivatives. Therefore, there may be far-reaching impacts of the announcement.

NYSE has not revealed a timeline for the launch. Additional regulatory filings are anticipated. Market participants will be closely monitoring progress.

At the end of the day, the initiative is a reflection of a two-fold strategy. NYSE is keeping its traditional exchange alive and kicking and building its successor. This approach is cognizant of present realities and future demand.

As tokenization progresses, institutions are faced with a defining choice. NYSE’s answer here is obvious and intentional. It is in preparation for both worlds at the same time.