Grayscale files SEC registration for BNB ETF, allowing investors exposure to BNB through regulated Grayscale ETFs.

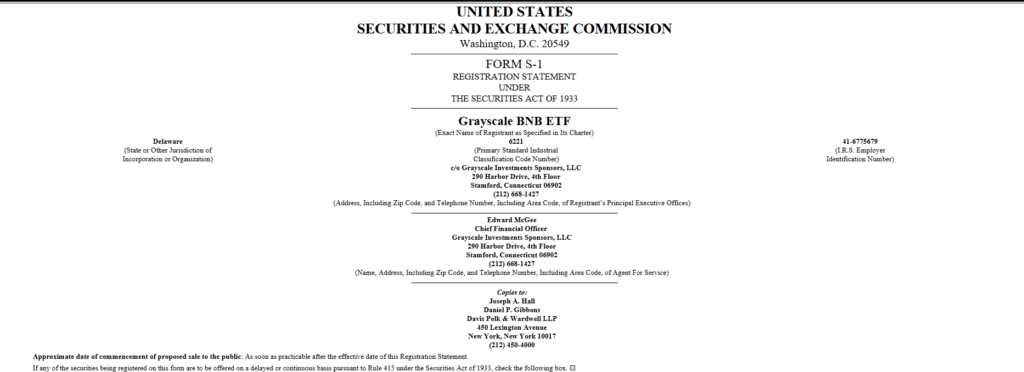

Grayscale has filed a Form S-1 with the U.S. SEC on January 23, 2026, to register a new BNB ETF. The fund is sponsored by Grayscale Investments Sponsors, LLC and incorporated in the state of Delaware. If it is approved, it will provide investors with a publicly traded ETF tracking BNB, which will provide easier access to cryptocurrency markets.

Grayscale ETF Registration Marks Major Step

Grayscale Investments filed their Form S-1 in order to register the spot BNB ETF known as Grayscale BNB Trust. The ETF being proposed would trade under a ticker symbol-GBNB. This filing starts the regulatory process, but permission is needed before trading can begin. Grayscale stock and Grayscale ETFs will likely benefit if the ETF is launched successfully.

The filing of an S-1 is an important step for Grayscale investment strategies. Investors who track Grayscale stocks, or are interested in Grayscale ETFs, should watch this filing as a possible investment growth opportunity. The filing indicates Grayscale is expanding its stable of regulated digital asset products, and is solidifying its leadership position in crypto-centric investment funds.

Regulatory Process and Challenges

The ETF cannot launch until the SEC approves a separate application for change of the 19b-4 rule from Nasdaq, the planned exchange on which it will be listed. The SEC might brand BNB as unregistered securities, which can end up delaying the approval. Grayscale’s filing addresses regulatory issues to comply with national laws. It also considers risks such as market manipulation.

Staking of the BNB tokens is not included in this proposal, probably because of regulatory uncertainty. Grayscale stock investors will note that this focus on a spot ETF has the advantage of limiting exposure to price movements without involving staking. The ETF plans to offer a regulated and easier method for investors to monitor the value of BNB in the market.

Grayscale investment products, Grayscale ETFs, have become popular to both retail and institutional investors. Grayscale is launching a BNB ETF to expand its crypto investment options. The ETF allows investors to access BNB without owning the cryptocurrency. This approach makes trading and storing BNB simpler for investors.

Grayscale Spot BNB ETF Offers New Investment Opportunities

Market observers point out that Grayscale is the second major asset manager to file for a spot BNB ETF. VanEck sent out a similar filing earlier, which is still pending. If Grayscale ETFs get the green light, they could offer more options for investors seeking to add BNB to diversified portfolios.

The Grayscale BNB ETF would provide investors with exposure to the change in price in BNB using traditional brokerage accounts. This method is less complicated than buying and securing the cryptocurrency itself. Investors who are following Grayscale stocks may view the ETF as a source of future growth and interest in Grayscale investment products.

As the SEC is reviewing the filing, Grayscale continues to lead in regulated crypto investment offerings. The ETF is consistent with the firm’s strategy to provide transparent, accessible digital asset products. Grayscale ETFs are important as another option for those looking for regulated exposure to cryptocurrency markets.