Chainlink launches continuous 24/5 U.S. equity and ETF data feeds, enabling DeFi platforms to access real-time stock markets onchain.

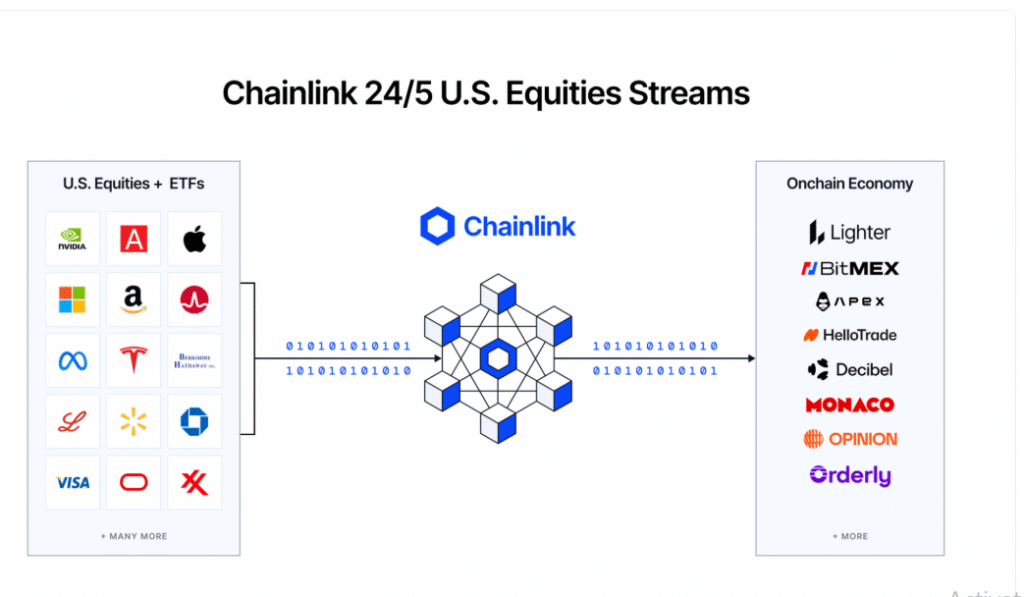

Chainlink has announced the launch of 24/5 U.S. Equities Streams, enabling continuous onchain access to U.S. stocks and ETFs across all trading sessions. This initiative to bring the approx. $80T US equity market onchain for decentralized finance applications across the globe.

Previously, equities in the United States were held back onchain because of disjointed market hours and incomplete data coverage. However, Chainlink is now providing prices, bid-ask data, volumes, and market status during the pre-market, regular, after-hours, and overnight sessions.

As a result, DeFi protocols have the potential to support onchain US equity perpetuals, prediction markets, lending products, and synthetic stocks without off hours blind spots. Moreover, traders get the possibility to use familiar equities and ETFs onchain 24/5 with greater pricing confidence.

Lighter and BitMEX Integrate Chainlink for Continuous RWA Trading

Importantly, the data feeds do not just focus on a single reference price and contain bid prices, ask prices, volumes, last traded prices and staleness indicators. Therefore, builders are able to deploy complex logic, more powerful risk controls and safer liquidation mechanisms.

In addition, Chainlink also confirmed that premier platforms have already embraced the solution across live markets. These include Lighter, the #2 perpetual DEX by volume, BitMEX, ApeX, HelloTrade, Decibel, Monaco, Opinion Labs and Orderly Network.

Furthermore, Chainlink Data Streams are live on over 40 global blockchains. This enables protocols to run equity markets outside of normal trading hours in the United States, enhancing continuity and accessibility to global users on the chain.

Continuous Data Addresses Structural Gaps in RWA Markets

Real-world assets onchain stand to hit $30T by 2030 by some industry estimates. However, U.S. equities have not been well represented because of mismatched trading hours and a lack of off-hours trading data.

Traditionally, most solutions that are on-chain were limited to those that provided equity prices during standard weekday sessions from 9:30 to 16:00 ET. As a result, this led to pricing discrepancies, higher off-hours risk and limited the scalability of equity-based DeFi products.

Chainlink developed 24/5 U.S. Equities Streams to convert fragmented equity data into continuous and cryptographically-signed data streams. As a result, onchain markets benefit from more reliable pricing, secure liquidations, and consistent user experiences between sessions.

Notably, the streams offer continuous sub-second pricing coverage and full market context beyond just the price. This includes market status flags, bid-ask volumes, mid prices and last traded prices for accurate execution.

Moreover, the infrastructure is built on top of the Chainlink Data Standard that has allowed for over $27T in transaction value and delivered over 19B verified onchain messages. As of now, it helps in securing around 70% of the oracle related DeFi activity.

The expanded data schema supports multiple onchain use cases, including perpetual derivatives, prediction markets, lending platforms, synthetic equities and structured yield products. Therefore, developers can create institutional-grade equity markets that are more precise.

Industry leaders were emphasizing the importance of data integrity in continuous derivatives trading. BitMEX stressed the importance of verifiable pricing outside of normal hours, whereas Lighter suggested better execution at no loss of fairness.

Looking ahead, Chainlink sees 24/5 U.S. Equities Streams as a milestone towards always-on, global accessible onchain finance. As coverage increases across assets and regions, continuous equity coverage may help to drive deeper liquidity, better risk management processes, and more resilient liquidation processes across DeFi markets.